We are now sitting right at some resistance levels in the S&P 500, and it will not surprise me to see the market trade lower on Friday ahead of the weekend, as traders look to book some nice profits for the week. However, it is nice to see some follow through, which suggests this rally has at least some short-term legs. To convince me that this will be a stronger Bear Market rally, we'll need to see another big up day next week.

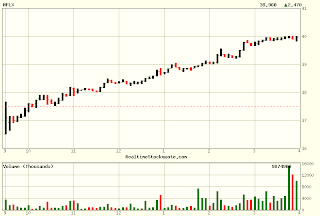

Because the market had rallied for a couple days prior to today, we did not have many low risk stock picks for day trades to the long side. However, one of those pics scored big, and was yet another example of a great directional trade that ran into the close...Netflix. The chart is below.

Good Trading!

Scott Cole

www.bestdaytradingstocks.com

No comments:

Post a Comment