Our favorite trade showed up again today as a weak Dollar led to solid gains in the U.S. Stock market. As usual, Gold was up sharply as well. All of the major averages posted nice gains today. However, most of the gains occurred in the first 30 minutes of trading, and the market was essentially range bound there after. Nonetheless, there were plenty of opportunities for day traders today. There were plenty of gap openings, plus, with Gold up, there were obvious opportunities in the gold stocks.

One interesting divergence in the marke though... Apple was down today. After opening up with the market, it closed much lower, and formed an outside trading day, a somewhat bearish configuration. It appears now that AMZN has clearly taken over the leadership of the Nasdaq.

Scott Cole www.bestdaytradingstocks.com

Tuesday, December 1, 2009

Sunday, November 29, 2009

Weekly Stock Market Review

Well, last week proved to be quite an interesting week for stocks. Normally, since it is a holiday week, there is seasonal favorability. The market got off to a good start on Monday, but failed to build on its gains over the next two sessions. Then, while we were enjoying the Thanksgiving holiday, turmoil erupted in the Middle East, as news out of Dubai suggested there may still be some hangover from the global real estate problems. Global stock markets were down sharply on Thursday, and opened lower on Friday. In the U.S., our markets needed to play a little catch up, and we opened down significantly, trading over 200 points to the down side on the Dow. But, it was a holiday shortened session with light volume, and the markets closed a bit off the lows.

We have a big week ahead. Early in the week we will see if there is any further fallout to the Dubai situation. Retailers will report how the official start to the holiday shopping season went. Then on Friday, there will be a new unemployment report, ahead of which President Obama is convening a jobs summit in an act of desperation to help out Democrats heading into the 2010 election cycle.

As usual, pay close attention to the Dollar. The strong correlation between Dollar weakness and stock market strength is still in place.

Scott Cole www.bestdaytradingstocks.com

We have a big week ahead. Early in the week we will see if there is any further fallout to the Dubai situation. Retailers will report how the official start to the holiday shopping season went. Then on Friday, there will be a new unemployment report, ahead of which President Obama is convening a jobs summit in an act of desperation to help out Democrats heading into the 2010 election cycle.

As usual, pay close attention to the Dollar. The strong correlation between Dollar weakness and stock market strength is still in place.

Scott Cole www.bestdaytradingstocks.com

Wednesday, November 25, 2009

Dollar Plunges, Stocks Barely Move

U.S. stocks ended the day barely to the upside, even as the Dollar was routed in Forex trading. The Dollar closed at 14 year lows against the Yen. The so called Yen carry trade has been fueling the rise in stocks since March, but they barely moved today. Commodities, on the other hand, enjoyed big gains...particularly in energies and precious metals. Gold was up $25 on the day at last check, trading at $1,191 in the cash market.

Sooner or later, stocks will start to not like such a weak dollar. It is also noted that there is tremendous correlation among most markets. As the dollar falls, stocks, bonds and gold have risen. Just imagine what will happen if there is any sort of spike in the Dollar caused by a potential geopolitical crisis, or if the Fed suddenly sees that it is time to start raising rates.

In my view, this is just another asset bubble. Even when stocks rise off of bear market lows, they never move as high, and as quickly as this market has.

Happy Thanksgiving!

Scott Cole www.bestdaytradingstocks.com

Sooner or later, stocks will start to not like such a weak dollar. It is also noted that there is tremendous correlation among most markets. As the dollar falls, stocks, bonds and gold have risen. Just imagine what will happen if there is any sort of spike in the Dollar caused by a potential geopolitical crisis, or if the Fed suddenly sees that it is time to start raising rates.

In my view, this is just another asset bubble. Even when stocks rise off of bear market lows, they never move as high, and as quickly as this market has.

Happy Thanksgiving!

Scott Cole www.bestdaytradingstocks.com

Monday, November 23, 2009

Dollar Falls, Stocks Rally, As Usual

U.S. Stocks opened strongly to the upside this morning, and held up all day, as the Dollar declined in Forex trading. Someone keeps on forgetting to turn off this broken record!

Another "as usual" though; volume was light. In fact, considering the size of the price move, volume was downright abysmal. Less money is going into these up days, and that can't be good. Volume will continue to lighten up the rest of this holiday week, and that can lead to increased volatility. As usual, pay attention to the Dollar.

The day proved to not be easy for daytraders, except very short term scalpers. Most of the big moves in individual stocks occurred in the first 30 minutes. After that, many stocks that traded nicely to the upside in the first half hour simply flattened out the rest of the day.

Scott Cole www.bestdaytradingstocks.com

Another "as usual" though; volume was light. In fact, considering the size of the price move, volume was downright abysmal. Less money is going into these up days, and that can't be good. Volume will continue to lighten up the rest of this holiday week, and that can lead to increased volatility. As usual, pay attention to the Dollar.

The day proved to not be easy for daytraders, except very short term scalpers. Most of the big moves in individual stocks occurred in the first 30 minutes. After that, many stocks that traded nicely to the upside in the first half hour simply flattened out the rest of the day.

Scott Cole www.bestdaytradingstocks.com

Sunday, November 22, 2009

Weekly Stock Market Review

As mentioned in my previous post this weekend, the U.S. stock market ended a quiet week on a quiet note on Friday. However, as we head into the holidays, we enter a pretty strong time frame for the stock market on a seasonal basis. Since we have had such as strong rally from the March lows, the market is actually significantly higher on the year. As a result, many fund managers have been left on the sidelines, missing much of this rally. You can bet that these fund managers will try to pile into stocks that have been leading the rally.

I suspect that many of the trends that have been in place during the bulk of this rally, such as a declining Dollar and rising commodity prices, will continue into the rest of the year. The leading industry groups continue to be Silver, Gold, metals/mining, and catalog businesses.

Heading into the Thanksgiving week, the market looks poised to make a move higher after a modest pullback over the last several trading days. I like the patterns I see on the major averages and many stocks in terms of setting up for a decent two or three day rally in the coming week. When you add to this that this is a seasonally favorable week, daytraders and short term swing traders should consider that the odds are likely in favor of the long side over the next several trading days.

There is one caveat to this little forecast, if you could call it that. If there is any significant weakness on Monday that carries the S&P 500 down below 1080, then I would anticipate further weakness.

Scott Cole www.bestdaytradingstocks.com

I suspect that many of the trends that have been in place during the bulk of this rally, such as a declining Dollar and rising commodity prices, will continue into the rest of the year. The leading industry groups continue to be Silver, Gold, metals/mining, and catalog businesses.

Heading into the Thanksgiving week, the market looks poised to make a move higher after a modest pullback over the last several trading days. I like the patterns I see on the major averages and many stocks in terms of setting up for a decent two or three day rally in the coming week. When you add to this that this is a seasonally favorable week, daytraders and short term swing traders should consider that the odds are likely in favor of the long side over the next several trading days.

There is one caveat to this little forecast, if you could call it that. If there is any significant weakness on Monday that carries the S&P 500 down below 1080, then I would anticipate further weakness.

Scott Cole www.bestdaytradingstocks.com

Friday, November 20, 2009

Stocks End Week With Modest Losses

U.S. Stocks closed very modestly lower on Friday in very dull trading, to end a very dull week of trading. As a result, the week ended mixed, with the Dow Industrials posting a modest gain, and most other averages posting modest losses on the week.

However, the daily trading pattern looks promising for a decent move to the upside next week, which is also a seasonally favorable week for the market.

More to come over the weekend!

Scott Cole www.bestdaytradingstocks.com

However, the daily trading pattern looks promising for a decent move to the upside next week, which is also a seasonally favorable week for the market.

More to come over the weekend!

Scott Cole www.bestdaytradingstocks.com

Thursday, November 19, 2009

Stocks End Day Lower, Dollar Up Modestly

U.S. Stocks finished they lower, but well off session lows on Thursday, but remain up solidly on the week. Stocks opened lower on the back of Dollar strength, but that strength evaporated late in the day, and allowed the market to bounce a bit off its lows. Overall though, it was a pretty weak market. One thing I definitely did not like about the price action was the weakness in Apple. Apple was down over $5 on the day, on rising volume. The overall market volume was also higher today.

In other markets, Gold eked out a small gain, while Crude Oil was lower by over $2. Otherwise, it was a fairly quiet day.

Keep an eye on the Dollar on Friday!

Scott Cole www.bestdaytradingstocks.com

In other markets, Gold eked out a small gain, while Crude Oil was lower by over $2. Otherwise, it was a fairly quiet day.

Keep an eye on the Dollar on Friday!

Scott Cole www.bestdaytradingstocks.com

Monday, November 16, 2009

Like a broken record, U.S. stocks enjoyed a nice Monday rally, as did many commodities, as the Dollar traded at its lowest level since August 2008. The Yen was the largest benefactor of the Dollar decline today, as the carry trade continues. The Dollar also fell against the Euro and British Pound.

Also benefiting from the Dollar decline was Gold, Silver, Crude Oil, and Copper, among other markets. Interestingly, in spite of a big rise in commodity prices and stocks, the 10 Year Treasury Note also rallied sharply, lower yields to their lowest levels since early October.

The question is, how long can we have a declining Dollar, low interest rates, a fast rising stock market, and higher commodity prices before something gives? I suspect we continue to see these trends through the end of the year. However, when the trend following commodity traders and hedge fund managers decide to head for the exits, they all tend to do so at the same time. You can definitely expect very sharp corrections to occur when that happens.

I suggest that the trends continue through the end of the year since fund managers will want to show strong yearly performance results to show their investors. Once that occurs, they will have no problem liquidating positions at the first sign of any kind of trouble for the markets. or when it becomes obvious that central banks have started to hit the liquidity breaks.

Stay tuned!

Scott Cole www.bestdaytradingstocks.com

Also benefiting from the Dollar decline was Gold, Silver, Crude Oil, and Copper, among other markets. Interestingly, in spite of a big rise in commodity prices and stocks, the 10 Year Treasury Note also rallied sharply, lower yields to their lowest levels since early October.

The question is, how long can we have a declining Dollar, low interest rates, a fast rising stock market, and higher commodity prices before something gives? I suspect we continue to see these trends through the end of the year. However, when the trend following commodity traders and hedge fund managers decide to head for the exits, they all tend to do so at the same time. You can definitely expect very sharp corrections to occur when that happens.

I suggest that the trends continue through the end of the year since fund managers will want to show strong yearly performance results to show their investors. Once that occurs, they will have no problem liquidating positions at the first sign of any kind of trouble for the markets. or when it becomes obvious that central banks have started to hit the liquidity breaks.

Stay tuned!

Scott Cole www.bestdaytradingstocks.com

Sunday, November 15, 2009

Weekly Stock Market Review

U.S. Stocks ended the week with a positive note, and finished with a two week winning streak. A weak Dollar again provided the prescription for the rally, as the market shrugged off a weak consumer sentiment survey. The Russell 2000 actually lead with a gain over 1% on the session, followed closely by the Nasdaq and Nasdaq 100.

This coming week could prove to be an important juncture in the markets. The Dow Industrials have already broken out to new highs for this bull move. The S&P 500 and Nasdaq indexes are sitting just below their highs, while the Russell 2000 and Dow Transports are well below their highs. If the Nasdaq and S&P 500 can move decisively above their highs, that will confirm that this bull move has more legs.

As always, I believe there are significant headwinds out there for the market. However, you can bet that if the averages continue higher, fund managers will have to plunge in and buy. They need to do their best to beat the averages for the year, and since the long side has been the place to be for the last eight months, they must be long, and they must be in the hot stocks.

Most of the headwinds facing the market are longer term issues. As such, since this is also a seasonally favorable time of year for the market, it is best to just stay on the long side, but I do not recommend the use of leverage.

Heading into Monday, we have a two week winning streak for Mondays as well. Don't be surprised by any strength in the market on Monday.

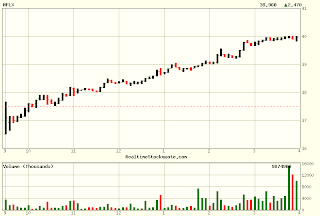

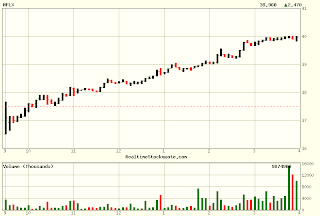

As always, since Friday was a positive day for the stock market, there were some nice daytrades. Check out the chart of CSIQ below. This stock was set up nicely by one of the patterns I like to see for a stock ready to make a big move to the upside. After opening slightly higher on the session, the stock did not disappoint, showing a 10% gain on the day.

Have a good week!

Scott Cole www.bestdaytradingstocks.com

This coming week could prove to be an important juncture in the markets. The Dow Industrials have already broken out to new highs for this bull move. The S&P 500 and Nasdaq indexes are sitting just below their highs, while the Russell 2000 and Dow Transports are well below their highs. If the Nasdaq and S&P 500 can move decisively above their highs, that will confirm that this bull move has more legs.

As always, I believe there are significant headwinds out there for the market. However, you can bet that if the averages continue higher, fund managers will have to plunge in and buy. They need to do their best to beat the averages for the year, and since the long side has been the place to be for the last eight months, they must be long, and they must be in the hot stocks.

Most of the headwinds facing the market are longer term issues. As such, since this is also a seasonally favorable time of year for the market, it is best to just stay on the long side, but I do not recommend the use of leverage.

Heading into Monday, we have a two week winning streak for Mondays as well. Don't be surprised by any strength in the market on Monday.

As always, since Friday was a positive day for the stock market, there were some nice daytrades. Check out the chart of CSIQ below. This stock was set up nicely by one of the patterns I like to see for a stock ready to make a big move to the upside. After opening slightly higher on the session, the stock did not disappoint, showing a 10% gain on the day.

Have a good week!

Scott Cole www.bestdaytradingstocks.com

Friday, November 13, 2009

Dollar Weak, Stocks Rise, As Usual

U.S. Stocks were up again Friday, resulting in a two week winning streak. Earnings and a weak Dollar were the primary drivers, as stocks shrugged off a weak Consumer Sentiment report that suggests holiday spending may not be very strong.

The Dollar weakness resulted in more strength in Gold and commodities although crude oil broke down through some recent support before closing just over $76.

Again, volume was light on an up day. Volume was markedly lower than on yesterday's sell off.

More to come over the weekend.

Scott Cole www.bestdaytradingstocks.com

The Dollar weakness resulted in more strength in Gold and commodities although crude oil broke down through some recent support before closing just over $76.

Again, volume was light on an up day. Volume was markedly lower than on yesterday's sell off.

More to come over the weekend.

Scott Cole www.bestdaytradingstocks.com

Thursday, November 12, 2009

Stocks Decline on Dollar Strength

U.S. Stocks declined on Thursday as the Dollar managed a decent rally, after making new lows for the current downtrend this week. Same old story here. As the Dollar falls, stocks rise, as it is seen as a boost to companies that compete in overseas markets. The falling Dollar also has provided a boost to Oil prices, and therefore Oil related stocks. Today, these stocks took a bit hit.

At some point this particular relationship will change, a falling Dollar will result in inflationary pressures. Inflation perceptions will ultimate result in higher interest rates, irregardless of what the Fed does. Higher interest rates are never a good thing for stocks.

Nonetheless, this is the market we are in. It is notable that the stock market appears to be struggling at these levels, and volume on down days continues to be higher than on up days. It is also clear that the stock market leadership has narrowed significantly. The Dow Industrials are the only average to make new highs for the move in the past week. None of the other major averages has made a new high. In fact, the Russell 2000 remains about 6% below its October highs.

In a recent post, due to the Dow breaking out to new highs, I mentioned that intermediate term traders needed to get back into the market with high momentum stocks breaking to new highs. However, I added, that this should be done with caution, and today's action bears that out. All traders and investors should be very cautious at this point due mainly to the policies that the powers that be in Washington are trying to push through, and the extremely high government debt.

Going forward, I expect that the daytrading opportunities will be just as plentiful on the short side as they will be on the upside.

Stay Tuned!

Scott Cole www.bestdaytradingstocks.com

At some point this particular relationship will change, a falling Dollar will result in inflationary pressures. Inflation perceptions will ultimate result in higher interest rates, irregardless of what the Fed does. Higher interest rates are never a good thing for stocks.

Nonetheless, this is the market we are in. It is notable that the stock market appears to be struggling at these levels, and volume on down days continues to be higher than on up days. It is also clear that the stock market leadership has narrowed significantly. The Dow Industrials are the only average to make new highs for the move in the past week. None of the other major averages has made a new high. In fact, the Russell 2000 remains about 6% below its October highs.

In a recent post, due to the Dow breaking out to new highs, I mentioned that intermediate term traders needed to get back into the market with high momentum stocks breaking to new highs. However, I added, that this should be done with caution, and today's action bears that out. All traders and investors should be very cautious at this point due mainly to the policies that the powers that be in Washington are trying to push through, and the extremely high government debt.

Going forward, I expect that the daytrading opportunities will be just as plentiful on the short side as they will be on the upside.

Stay Tuned!

Scott Cole www.bestdaytradingstocks.com

Tuesday, November 10, 2009

Ho Hum Day For Stocks

U.S. stocks ended the day mixed, with the Dow Jones and Nasdaq 100 posting modest gains on light volume while the other major averages traded lower. The Dollar traded within a choppy and narrow trading range, and the stock market essentially followed suit.

The big news of the day for stocks was Priceline posted earnings that tripled in the 3rd quarter. The stock closed up over 17%. Surprisingly, the Nasdaq Composite failed to have a positive close as a result.

The bottom line was that this was a boring trading day, and day traders would have been smart to call it a day early and go play some golf!

Scott Cole www.bestdaytradingstocks.com

The big news of the day for stocks was Priceline posted earnings that tripled in the 3rd quarter. The stock closed up over 17%. Surprisingly, the Nasdaq Composite failed to have a positive close as a result.

The bottom line was that this was a boring trading day, and day traders would have been smart to call it a day early and go play some golf!

Scott Cole www.bestdaytradingstocks.com

Monday, November 9, 2009

Stocks Rally on G-20 news

U.S. Stocks followed up on a rally that started overseas on the back of news out of a G-20 meeting of finance ministers indicating that they are not ready to start pulling back on the liquidity they have been injecting in support of the global economy. The Dollar plunged and is testing its most recent lows again, after making a multi-week high just last week.

The result was a big rally across the board, which carried the Dow Jones Industrial Average to new bull market highs, over 10,200. Volume was moderately higher than the last couple of trading sessions.

Commodity prices rallied on the news, with oil prices up $2 and Gold rallying to new all time highs over $1,100.

Not surprisingly, we had some big individual stock moves, resulting in some nice day trades! The trade of the day was TRW. Along with the overall market, it gapped to the upside, and then followed through on its opening strength with continued strength in the first part of the trading day. Traders applying any type of opening range breakout strategy could just hop on board and ride the trend to a gain of at least $1.00 per share depending upon the entry price.

For intermediate term traders, you pretty much have to hop back on the train again on a session like today if you had gone to cash during the recent pullback. The market appears to be re-establishing its upside momentum, although there appears to be a narrowing of leadership, as smaller stocks are nowhere near the recent highs as gauged by the Russell 2000. However, now is not a time to apply much leverage.

Stay tuned!

Scott Cole www.bestdaytradingstocks.com

The result was a big rally across the board, which carried the Dow Jones Industrial Average to new bull market highs, over 10,200. Volume was moderately higher than the last couple of trading sessions.

Commodity prices rallied on the news, with oil prices up $2 and Gold rallying to new all time highs over $1,100.

Not surprisingly, we had some big individual stock moves, resulting in some nice day trades! The trade of the day was TRW. Along with the overall market, it gapped to the upside, and then followed through on its opening strength with continued strength in the first part of the trading day. Traders applying any type of opening range breakout strategy could just hop on board and ride the trend to a gain of at least $1.00 per share depending upon the entry price.

For intermediate term traders, you pretty much have to hop back on the train again on a session like today if you had gone to cash during the recent pullback. The market appears to be re-establishing its upside momentum, although there appears to be a narrowing of leadership, as smaller stocks are nowhere near the recent highs as gauged by the Russell 2000. However, now is not a time to apply much leverage.

Stay tuned!

Scott Cole www.bestdaytradingstocks.com

Sunday, November 8, 2009

Weekly Stock Market Review

U.S. Stocks closed the week of trading essentially unchanged on Friday, but in the process, ended a two week losing streak. The S&P 500 traded the last three sessions to the upside, but on each successive day, volume shrunk. While it is certainly possible for a rally to occur on Monday, since Friday's trading range was quite narrow on low volume, the odds suggest some difficulty for the market trading to higher levels in the next couple of days.

As usual, the leading groups during the rally this week were commodity based industries, with Silver miners leading the way. Drug related industries were a close second behind Silver, while the Metals & Mining, Copper, and Steel & Iron groups rounded out the top five industries.

In other markets, Gold was the headline mover among commodities, as it broke out to new all time highs, and tested the $1,100 per ounce level. This helped pull Silver higher, which is again testing $18 per ounce.

After rallying to 4 week highs, the Dollar Index sold off late in the week and closed lower for the week. In spite of the Dollar pullback late in the week, 10 Year Treasury Notes managed to rally on word of the 10.2% unemployment figure reported in Friday's release of government employment figures. This is the highest level since the 1981-82 recession.

Over the weekend, the U.S. House of Representatives passed its version of a healthcare reform bill, with a $1.2 trillion price tag. While many view this version of the bill to be dead on arrival as debate moves to the Senate, it still does suggest that some form of healthcare reform will be passed in the foreseeable future, probably early next year. While there does appear to be some burden on business, the stock market has shrugged this off so far. It will be interesting to see how the market reacts as the bill moves closer to passage.

As earnings season is nearly over, all focus will return to economic data. With the holidays ahead, you can bet there will be a lot of attention paid to retail sales.

Stay Tuned!

Scott Cole www.bestdaytradingstocks.com

As usual, the leading groups during the rally this week were commodity based industries, with Silver miners leading the way. Drug related industries were a close second behind Silver, while the Metals & Mining, Copper, and Steel & Iron groups rounded out the top five industries.

In other markets, Gold was the headline mover among commodities, as it broke out to new all time highs, and tested the $1,100 per ounce level. This helped pull Silver higher, which is again testing $18 per ounce.

After rallying to 4 week highs, the Dollar Index sold off late in the week and closed lower for the week. In spite of the Dollar pullback late in the week, 10 Year Treasury Notes managed to rally on word of the 10.2% unemployment figure reported in Friday's release of government employment figures. This is the highest level since the 1981-82 recession.

Over the weekend, the U.S. House of Representatives passed its version of a healthcare reform bill, with a $1.2 trillion price tag. While many view this version of the bill to be dead on arrival as debate moves to the Senate, it still does suggest that some form of healthcare reform will be passed in the foreseeable future, probably early next year. While there does appear to be some burden on business, the stock market has shrugged this off so far. It will be interesting to see how the market reacts as the bill moves closer to passage.

As earnings season is nearly over, all focus will return to economic data. With the holidays ahead, you can bet there will be a lot of attention paid to retail sales.

Stay Tuned!

Scott Cole www.bestdaytradingstocks.com

Thursday, November 5, 2009

Stocks Enjoy Broad Rally

U.S. Stocks rallied across the board on Thursday on the back of a variety of news items. Some retailers are reporting better than expected sales in October, suggesting the holiday season may give a lift to the economy. Weekly jobless claims dropped significantly, and it was reported that 3rd quarter productivity was up over 9%, higher than the previously reported 6.6%. Finally, the European and UK central banks held interest rates steady, but suggested they will be pulling back on debt purchases.

All of the major averages were up significantly, and closed at the highs of the day. Once again though, volume was low, although the Nasdaq averages had similar volume to yesterday.

The market had been oversold to the downside, and had pulled back to, and in some averages, below major support. The Dow Jones Industrial Average is still trading within an uptrend that really has not been broken. The other averages clearly have broken technical support levels and will find it more difficult to make new highs. More significant positive news on the economy will be required to keep the market going higher.

With all that in mind, it was a good day for day traders playing the long side. Yesterday I mentioned that the overall technical pattern of the markets on a short term basis was not favorable. However, that was over ridden with a strong trending move to the upside. The market started higher and never looked back all day. These are the kinds of days where daytraders can make spectacular gains. Check out the chart of AWI below. This stock brought day traders 10% on the day by trading a standard opening range breakout. This is the type of trade that can make your month!

Scott Cole www.bestdaytradingstocks.com

All of the major averages were up significantly, and closed at the highs of the day. Once again though, volume was low, although the Nasdaq averages had similar volume to yesterday.

The market had been oversold to the downside, and had pulled back to, and in some averages, below major support. The Dow Jones Industrial Average is still trading within an uptrend that really has not been broken. The other averages clearly have broken technical support levels and will find it more difficult to make new highs. More significant positive news on the economy will be required to keep the market going higher.

With all that in mind, it was a good day for day traders playing the long side. Yesterday I mentioned that the overall technical pattern of the markets on a short term basis was not favorable. However, that was over ridden with a strong trending move to the upside. The market started higher and never looked back all day. These are the kinds of days where daytraders can make spectacular gains. Check out the chart of AWI below. This stock brought day traders 10% on the day by trading a standard opening range breakout. This is the type of trade that can make your month!

Scott Cole www.bestdaytradingstocks.com

Wednesday, November 4, 2009

Stocks End Day Mixed After Fed Meeting

U.S. Stocks closed mixed after trading much higher in the afternoon following the Fed's announcement to keep interest rates unchanged. The Dow Jones rose to up as much as 140 points, before stocks sold off in the last hour.

The daily trading pattern suggests we may test the recent lows in the next couple of days. The Friday employment report will hold the key. Today's ADP report indicated another loss of 200,000 jobs. I still see CNBC analysts suggesting jobs are ready to turnaround, based upon recent productivity figures.

The Dollar was hit hard today, which is interesting, because the stock market did not go anywhere. Gold flirted with $1,100 before settling back down with a gain of a couple bucks. 10 Year Treasury yields were about 3.55% the last I saw, and that is a bit of a pop from around 3.41% earlier in the week.

I have no clue what the market will do in the next couple of days, but the pattern suggest a re-test of the recent lows should occur soon. The European and UK central banks meet tomorrow to discuss policy, but keep an eye on jobless claims here in the U.S. They have been quite steady as of late, and a lack of improvement may start an early sell-off before Friday's employment report.

Scott Cole www.bestdaytradingstocks.com

The daily trading pattern suggests we may test the recent lows in the next couple of days. The Friday employment report will hold the key. Today's ADP report indicated another loss of 200,000 jobs. I still see CNBC analysts suggesting jobs are ready to turnaround, based upon recent productivity figures.

The Dollar was hit hard today, which is interesting, because the stock market did not go anywhere. Gold flirted with $1,100 before settling back down with a gain of a couple bucks. 10 Year Treasury yields were about 3.55% the last I saw, and that is a bit of a pop from around 3.41% earlier in the week.

I have no clue what the market will do in the next couple of days, but the pattern suggest a re-test of the recent lows should occur soon. The European and UK central banks meet tomorrow to discuss policy, but keep an eye on jobless claims here in the U.S. They have been quite steady as of late, and a lack of improvement may start an early sell-off before Friday's employment report.

Scott Cole www.bestdaytradingstocks.com

Sunday, November 1, 2009

Weekly Stock Market Re-Cap

U.S. Stocks closed the week with significant losses on Friday, which sent the Nasdaq Composite, and a few other averages, to their first monthly losses since this bull run began in March. Based upon the market action of the past couple of weeks, it is clear we have entered correction mode. The character of the stock market has clearly changed. For instance, early morning gains have turned into late day losses. That is not characteristic of a market that will be trading higher. Also, individual stocks have taken hits AFTER reporting earnings above expectations.

I would add that it has seemed to me that most of the commentators on CNBC have been quite bullish heading into the last couple of weeks. They all point to a continued recovery in business inventories and continued stimulus spending as keys to an economic recovery, which should continue to boost the stock market. I continue to ask where the consumer spending will come from considering the fact that the residential real estate market is still weak, and with an unemployment rate that likely will head above 10% in the foreseeable future.

I have noted economist after economist suggesting that there is indeed a recovery going on in residential real estate. As such, this past week's report that new home sales were down in the latest month was a shocker to them. In my own neighborhood, I have seen one home sit on the market for over a year. Indeed, it is a flawed home, but now is priced well below its purchase price by the current owner four years ago. I have seen other homes in the neighborhood sit on the market for several months, much longer than normal.

I have been a commercial real estate appraiser for over 20 years. One recent study I conducted in my own area here in Harrisburg, Pennsylvania indicates that commercial real estate transactions are down about 40% since 2007. Capitalization rates have risen dramatically. Vacancy rates have been on the rise, and this is pressuring rental rates. It is clear that many properties purchased in the 2006-2008 period are under water in many locations around the country. Therefore, there will be another shoe to drop for this economy.

I believe this stock market rally has been quite bogus. I am sure that in March, we hit a significant low, and the market sold off more than it should have. But, a rally of nearly 60% since then seems unwarranted considering the headwinds we still face. Huge government deficits and an administration that seems to want to add more to them in spite of their words. An extremely weak Dollar. Oil prices back over $75 heading into Winter. A healthcare bill likely to add more of a burden to businesses, along with a push for a cap and trade bill on energy.

In any event, the market is getting quite volatile again. I think there is more room to the downside, but short sellers need to be very careful and nimble.

Scott Cole www.bestdaytradingstocks.com

I would add that it has seemed to me that most of the commentators on CNBC have been quite bullish heading into the last couple of weeks. They all point to a continued recovery in business inventories and continued stimulus spending as keys to an economic recovery, which should continue to boost the stock market. I continue to ask where the consumer spending will come from considering the fact that the residential real estate market is still weak, and with an unemployment rate that likely will head above 10% in the foreseeable future.

I have noted economist after economist suggesting that there is indeed a recovery going on in residential real estate. As such, this past week's report that new home sales were down in the latest month was a shocker to them. In my own neighborhood, I have seen one home sit on the market for over a year. Indeed, it is a flawed home, but now is priced well below its purchase price by the current owner four years ago. I have seen other homes in the neighborhood sit on the market for several months, much longer than normal.

I have been a commercial real estate appraiser for over 20 years. One recent study I conducted in my own area here in Harrisburg, Pennsylvania indicates that commercial real estate transactions are down about 40% since 2007. Capitalization rates have risen dramatically. Vacancy rates have been on the rise, and this is pressuring rental rates. It is clear that many properties purchased in the 2006-2008 period are under water in many locations around the country. Therefore, there will be another shoe to drop for this economy.

I believe this stock market rally has been quite bogus. I am sure that in March, we hit a significant low, and the market sold off more than it should have. But, a rally of nearly 60% since then seems unwarranted considering the headwinds we still face. Huge government deficits and an administration that seems to want to add more to them in spite of their words. An extremely weak Dollar. Oil prices back over $75 heading into Winter. A healthcare bill likely to add more of a burden to businesses, along with a push for a cap and trade bill on energy.

In any event, the market is getting quite volatile again. I think there is more room to the downside, but short sellers need to be very careful and nimble.

Scott Cole www.bestdaytradingstocks.com

Friday, October 30, 2009

Stock Market Sells Off, Again

U.S. Stocks sold off sharply on Friday on the back of some more weak economic news suggesting that the 3rd Quarter GDP is being followed by disappointment in the 4th Quarter. The Nasdaq closed below its October 1st close. The Russell 2000 and Dow Transports accomplished that feat on Wednesday. Volume was heavy. This market looks like it has further to go on the downside.

More to come on the weekend.

Scott Cole

www.bestdaytradingstocks.com

More to come on the weekend.

Scott Cole

www.bestdaytradingstocks.com

Thursday, October 29, 2009

Stocks Rally on GDP Report

U.S. Stocks rallied after the government reported GDP growth in the 3rd Quarter of 3.5%. Combined with the old weak dollar trade, and an oversold market, the stock market had plenty of reason to rally today and squeeze some shorts in the process. This may carry through for a couple days, but it is notable that volume today was lighter than yesterday.

If you are a daytrader, you should have been ready for a decent bounce to the upside. The market was clearly oversold after a relatively sharp pull back in the last week. Then, all you had to do was look for some stocks that were gapping higher on the open, or had decent trading set ups suggesting a bias to the upside.

Medifast (MED) was one of those stocks poised for an upside move. After a sharp pullback in the last week, it seemed to find support yesterday and traded within a narrow range, its narrowest in four sessions. It then opened strongly this morning and traded up sharply in the first half hour. This was a tough trade to take due to the fact that the stock moved well over a dollar in the first half hour. It then broke out of its early range and traded up over another dollar above its breakout price, before settling into a trading range for the rest of the day. See the chart below.

Scott Cole

www.bestdaytradingstocks.com

If you are a daytrader, you should have been ready for a decent bounce to the upside. The market was clearly oversold after a relatively sharp pull back in the last week. Then, all you had to do was look for some stocks that were gapping higher on the open, or had decent trading set ups suggesting a bias to the upside.

Medifast (MED) was one of those stocks poised for an upside move. After a sharp pullback in the last week, it seemed to find support yesterday and traded within a narrow range, its narrowest in four sessions. It then opened strongly this morning and traded up sharply in the first half hour. This was a tough trade to take due to the fact that the stock moved well over a dollar in the first half hour. It then broke out of its early range and traded up over another dollar above its breakout price, before settling into a trading range for the rest of the day. See the chart below.

Scott Cole

www.bestdaytradingstocks.com

Wednesday, October 28, 2009

Stock Market Continues Sell-Off

U.S. Stocks closed at their lows of the day today, with their worst losses since October 1st. The worst performer among the major averages was the Russell 2000, down over 20 points on the session. This took the average below its October lows, suggesting a significant double top is in place.

The Dow Jones Industrial Average continues to hold up a bit better than the rest of the averages, down only 1.21% today. By contrast, the Nasdaq Composite was off over 2.6%.

The culprits today were a stronger Dollar, which rallied for a 5th day in a row, and a weaker than expected report on new home sales, which were reported to be down over 3% in September.

For intermediate term traders who trade high momentum stocks, today's activity should have you 100% in cash if you aren't there already. Daytraders should find the going easier on the short side than on the long side until we see a move to the upside that is at least as strong as today's move was to the downside.

Stay Tuned!

Scott Cole

www.bestdaytradingstocks.com

The Dow Jones Industrial Average continues to hold up a bit better than the rest of the averages, down only 1.21% today. By contrast, the Nasdaq Composite was off over 2.6%.

The culprits today were a stronger Dollar, which rallied for a 5th day in a row, and a weaker than expected report on new home sales, which were reported to be down over 3% in September.

For intermediate term traders who trade high momentum stocks, today's activity should have you 100% in cash if you aren't there already. Daytraders should find the going easier on the short side than on the long side until we see a move to the upside that is at least as strong as today's move was to the downside.

Stay Tuned!

Scott Cole

www.bestdaytradingstocks.com

Tuesday, October 27, 2009

Mixed but Weak Day for Stocks

The Dow Jones Industrial Average finished with marginal gains today. You would have thought the rest of the market was close to unchanged as well. Not the case! Most of the other major averages were down at least 1%, and once again market breadth was weak! At the moment, day traders can definitely make money on the short side! Follow the weak stocks and look for good set ups or major breakouts!

The chart of SNDA below is a good example of an opening range breakout that resulted in an all day trending move.

Scott Cole

www.bestdaytradingstocks.com

The chart of SNDA below is a good example of an opening range breakout that resulted in an all day trending move.

Scott Cole

www.bestdaytradingstocks.com

Monday, October 26, 2009

Stock Market Weak Again

U.S. Stocks closed lower on Monday, following through on Friday's losses. We have not seen the Monday follow through to the downside very often in this bull market that began in March. This suggests there is more room to the downside. On the S&P 500, this is major trend line support from the March and July lows at around the 1050 to 1055 level. A breach of that on significant volume should result in a test of the October lows at around 1020.

As mentioned in my earlier post, the main culprit was a strong Dollar. This resulted in an unwinding of the commodity trade, as Gold and Crude Oil were both weak today. The stock market has been propped up by the liquidity injected by the Fed and Treasury since last year. Some better than expected earnings reports added some more fuel to the rally, but it looks like it may be running out of steam. Some companies are now getting hit even when they meet expectations or slightly out perform.

Another issue facing the market, which is propping up the Dollar, is higher interest rates. The yield on the 10 Year Treasury Note settled at around 3.55% today. A further rise in yields will result in multi-month highs. There is a great deal of supply of treasuries coming this week, which could pressure prices further.

The bottom line is that you simply can not have a falling Dollar with rising stocks and rising commodities for very long. Something eventually has to give. One commentator brought to mind the 1987 crash today. That event was preceded by a weak dollar with low interest rates that eventually had to start going up. When interest rates spiked, the stock market collapsed.

Earlier this year, the 10 Year Note approached 4% yields and I believe went above those levels briefly. If you see that again, and they stay above that level for an extended period of time, watch for a big drop in stocks.

As I've mentioned, day traders need to be aware of shorting opportunities in the market now, rather than just focus on the long side.

Scott Cole

www.bestdaytradingstocks.com

As mentioned in my earlier post, the main culprit was a strong Dollar. This resulted in an unwinding of the commodity trade, as Gold and Crude Oil were both weak today. The stock market has been propped up by the liquidity injected by the Fed and Treasury since last year. Some better than expected earnings reports added some more fuel to the rally, but it looks like it may be running out of steam. Some companies are now getting hit even when they meet expectations or slightly out perform.

Another issue facing the market, which is propping up the Dollar, is higher interest rates. The yield on the 10 Year Treasury Note settled at around 3.55% today. A further rise in yields will result in multi-month highs. There is a great deal of supply of treasuries coming this week, which could pressure prices further.

The bottom line is that you simply can not have a falling Dollar with rising stocks and rising commodities for very long. Something eventually has to give. One commentator brought to mind the 1987 crash today. That event was preceded by a weak dollar with low interest rates that eventually had to start going up. When interest rates spiked, the stock market collapsed.

Earlier this year, the 10 Year Note approached 4% yields and I believe went above those levels briefly. If you see that again, and they stay above that level for an extended period of time, watch for a big drop in stocks.

As I've mentioned, day traders need to be aware of shorting opportunities in the market now, rather than just focus on the long side.

Scott Cole

www.bestdaytradingstocks.com

Sunday, October 25, 2009

Weekly Stock Market Review

U.S. stocks ended last week on a down note, with the major averages losing anywhere from 0.5% to over 2.0% for the Russell 2000. The Nasdaq averages held up better on Friday with the help of Amazon, which finished the session up over 26% on bullish earnings. That stock was also the daytrading star of the day as all you had to do was enter long at some point in the first 45 minutes and you had a 3 to 4 point gain by the close.

Back in 2007, before the bull market ended, the Nasdaq was dominated by the "4 horseman" stocks, namely, Apple, Google, Research in Motion and Amazon. Once the bear market ended in March, all four stocks began to rise again. However, RIMM over the last couple months has rolled over and appears to have fallen out of favor, possibly due to the Apple I-Phone.

Copper stocks remain the hottest industry group over the last month, followed by farm and construction machinery, catalogs, recreational vehicles and silver stocks.

10 Year Treasury Notes broke through initial support levels, leaving yields at around 3.5%, the highest levels in over a month. The Dollar managed a small rally on Friday, but still closed the week with a loss. Gold and Crude Oil closed with minor losses on Friday.

Scott Cole

bestdaytradingstocks.com

Back in 2007, before the bull market ended, the Nasdaq was dominated by the "4 horseman" stocks, namely, Apple, Google, Research in Motion and Amazon. Once the bear market ended in March, all four stocks began to rise again. However, RIMM over the last couple months has rolled over and appears to have fallen out of favor, possibly due to the Apple I-Phone.

Copper stocks remain the hottest industry group over the last month, followed by farm and construction machinery, catalogs, recreational vehicles and silver stocks.

10 Year Treasury Notes broke through initial support levels, leaving yields at around 3.5%, the highest levels in over a month. The Dollar managed a small rally on Friday, but still closed the week with a loss. Gold and Crude Oil closed with minor losses on Friday.

Scott Cole

bestdaytradingstocks.com

Thursday, October 22, 2009

Stocks Manage Mixed Gains

The headline number, the Dow Jones Industrial Average, up 131 points, or 1.33%, suggested a big up day for the market. But, the Nasdaq Composite was up barely .5% and the Dow Transports barely eked out a gain at all. Additionally, today's gains were on declining volume compared to yesterday.

Generally speaking, the price trend in the market is still up, but there are warning signs that this market is getting tired. As I mentioned yesterday, day traders should start considering the short side, especially if the tape indicators are weak during the day.

Today's chart of the day is HNI. The stock gapped up strongly at the open, and held steady for the next hour, before resuming its upward strength. Patient day traders could have traded the opening range breakout, or a pull back into support after the breakout. The stock trended higher for the rest of the session. Have a look at the chart below.

Scott Cole

www.bestdaytradingstocks.com

Generally speaking, the price trend in the market is still up, but there are warning signs that this market is getting tired. As I mentioned yesterday, day traders should start considering the short side, especially if the tape indicators are weak during the day.

Today's chart of the day is HNI. The stock gapped up strongly at the open, and held steady for the next hour, before resuming its upward strength. Patient day traders could have traded the opening range breakout, or a pull back into support after the breakout. The stock trended higher for the rest of the session. Have a look at the chart below.

Scott Cole

www.bestdaytradingstocks.com

Wednesday, October 21, 2009

Stocks Closer Lower on Higher Volume

U.S. Stocks traded higher in the early going, only to reverse and close lower for the day, with losses accelerating in the last hour. Volume was somewhat heavy, suggesting another bout of distribution. The market has been making a habit of trading higher on light volume days and lower on heavier volume days. This is a clear sign of the market struggling at these levels, suggesting it is due for a correction.

Due to continued strength in the shares of Apple, the Nasdaq Composite and Nasdaq 100 did not sell off nearly as much as the Dow and S&P 500. The more economically sensitive Dow Transports were the hardest hit, dropping nearly 1.3% on the session.

The interesting thing to note about today's trading is that the Dollar got hammered in the Forex markets, and crude oil jumped above $81 per barrel. Over the summer, this would have been a recipe for a big rally in stocks. Not today. So, we will see whether today's activity turns into a trend.

I will say this though, seeing crude oil jump to over $81 per barrel is not a good sign. Remember it was only 7 months ago that crude bottomed at around $35. That huge drop in energy prices from last year had the effect of a tax cut. I suspect that the lower energy prices over the summer, plus a rallying stock market helped consumer confidence. That was certainly reflected in the consumr sentiment surveys over the summer. The more recent consumer sentiment surveys are indicating a more downbeat public now. If crude oil gets anywhere near $100 per barrel in the near future, you can bet the stock market will drop significantly. $100 crude oil will do more to stifle the economy than anything else, with the home heating season starting in another month.

Daytraders in the stock market should start considering shorting opportunities going forward. The easy money has been made on the long side for the last six months. Now, at the least, you need to consider both sides of the equation.

Scott Cole

www.bestdaytradingstocks.com

Due to continued strength in the shares of Apple, the Nasdaq Composite and Nasdaq 100 did not sell off nearly as much as the Dow and S&P 500. The more economically sensitive Dow Transports were the hardest hit, dropping nearly 1.3% on the session.

The interesting thing to note about today's trading is that the Dollar got hammered in the Forex markets, and crude oil jumped above $81 per barrel. Over the summer, this would have been a recipe for a big rally in stocks. Not today. So, we will see whether today's activity turns into a trend.

I will say this though, seeing crude oil jump to over $81 per barrel is not a good sign. Remember it was only 7 months ago that crude bottomed at around $35. That huge drop in energy prices from last year had the effect of a tax cut. I suspect that the lower energy prices over the summer, plus a rallying stock market helped consumer confidence. That was certainly reflected in the consumr sentiment surveys over the summer. The more recent consumer sentiment surveys are indicating a more downbeat public now. If crude oil gets anywhere near $100 per barrel in the near future, you can bet the stock market will drop significantly. $100 crude oil will do more to stifle the economy than anything else, with the home heating season starting in another month.

Daytraders in the stock market should start considering shorting opportunities going forward. The easy money has been made on the long side for the last six months. Now, at the least, you need to consider both sides of the equation.

Scott Cole

www.bestdaytradingstocks.com

Monday, October 19, 2009

Stocks Make New Bull Market Highs

U.S. Stocks continued their seven month bull market, as S&P 500 nudged up against 1,100, before closing at 1,097 and change. Stocks were set to open trading to the upside today on continued positive earnings reports, and held up nicely for the day.

Many high momentum stocks broke out of small consolidations to new highs today. One big one, Apple, will do so on Tuesday morning after it blew away Wall Street earnings estimates after the close of trading. Apple has traded after hours over the $200 level to new all time highs.

With a nice move to the upside, there were some more big intraday moves in day trading stocks. The biggest high flyer of the year, Deidrich Coffee (DDRX), which is up 14,000% from its lows (yes, you read that correctly!), surged another 20% today. This was a classic opening range breakout trade that carried momentum all day into the close. The stock broke out of its early trading range just below $26 and closed at $29.33 on its heaviest volume of trading ever. Have a look at the chart below.

In other markets, like a broken record, the Dollar made new lows and Crude Oil moved higher. Gold also pushed higher to close at $1,058 and change on the December contract. 10 Year Treasury Notes managed to close modestly higher on the session.

Good Trading!

Scott Cole

www.bestdaytradingstocks.com

Many high momentum stocks broke out of small consolidations to new highs today. One big one, Apple, will do so on Tuesday morning after it blew away Wall Street earnings estimates after the close of trading. Apple has traded after hours over the $200 level to new all time highs.

With a nice move to the upside, there were some more big intraday moves in day trading stocks. The biggest high flyer of the year, Deidrich Coffee (DDRX), which is up 14,000% from its lows (yes, you read that correctly!), surged another 20% today. This was a classic opening range breakout trade that carried momentum all day into the close. The stock broke out of its early trading range just below $26 and closed at $29.33 on its heaviest volume of trading ever. Have a look at the chart below.

In other markets, like a broken record, the Dollar made new lows and Crude Oil moved higher. Gold also pushed higher to close at $1,058 and change on the December contract. 10 Year Treasury Notes managed to close modestly higher on the session.

Good Trading!

Scott Cole

www.bestdaytradingstocks.com

Sunday, October 18, 2009

Weekly Stock Market Commentary

U.S. Stocks ended the week with some losses on Friday, but closed the week out with gains compared to the previous week. Earnings were the primarily driver of stock prices to the upside throughout the week, but the market reacted negatively to IBM's earnings report on Friday. As a result, the week ended with modest gains within a very narrow trading range.

It is notable that the Nasdaq, Nasdaq 100 and Russell 2000 are finding some resistance at the September highs, while the Dow and S&P 500 have blown through there highs relatively easily. I also noted higher weekly volume compared to the previous week in the Dow and S&P 500, while this was not the case for the Nasdaq. This suggests that much of the recent strength has been in the financials.

Among the top industry groups, the oil and gas equipment services industry appears to be making a solid move, closing strongly to the upside this week, while many leading industry groups simply consolidated gains.

In other markets, the Dollar continued its slide, with another down week, but held steady on Friday. Crude oil broke out of a four month basis and surged to close over $78 for the week. $80 crude oil seems to be a foregone conclusion. If there is one lesson we need to remember from 2008 is that $100 crude oil definitely has a negative economic impact. A continued surge in crude oil will only result in more pressure on businesses and families already struggling to pay bills.

Gold closed a bit lower on Friday and finished somewhat unchanged on the week, but is still a bit above nearby support levels at around $1,020. Expect to see another leg up after some consolidation.

For the next week, expect earnings reports to continue to drive stock prices. Many of the important economic reports are out of the way for October. As such, the focus will be on earnings, unless there is a more significant drop in the Dollar, or a big surge in oil prices. Keep in mind that the S&P 500 is somewhat heavily weighted with oil stocks, so higher prices may continue to help with that average. On the other hand, you might see more erratic stock price behavior in the Nasdaq and Russell 2000.

With all this in mind, I would continue to exercise caution due to economic headwinds that face the market in the longer run. This rally has priced in a good bit of stability of the next 12 months, but until we see significant improvement in job creation, I don't see how the consumer based U.S. economy performs very well. Traders and investors might do a lot better to continue focusing on overseas businesses.

Scott Cole www.bestdaytradingstocks.com

It is notable that the Nasdaq, Nasdaq 100 and Russell 2000 are finding some resistance at the September highs, while the Dow and S&P 500 have blown through there highs relatively easily. I also noted higher weekly volume compared to the previous week in the Dow and S&P 500, while this was not the case for the Nasdaq. This suggests that much of the recent strength has been in the financials.

Among the top industry groups, the oil and gas equipment services industry appears to be making a solid move, closing strongly to the upside this week, while many leading industry groups simply consolidated gains.

In other markets, the Dollar continued its slide, with another down week, but held steady on Friday. Crude oil broke out of a four month basis and surged to close over $78 for the week. $80 crude oil seems to be a foregone conclusion. If there is one lesson we need to remember from 2008 is that $100 crude oil definitely has a negative economic impact. A continued surge in crude oil will only result in more pressure on businesses and families already struggling to pay bills.

Gold closed a bit lower on Friday and finished somewhat unchanged on the week, but is still a bit above nearby support levels at around $1,020. Expect to see another leg up after some consolidation.

For the next week, expect earnings reports to continue to drive stock prices. Many of the important economic reports are out of the way for October. As such, the focus will be on earnings, unless there is a more significant drop in the Dollar, or a big surge in oil prices. Keep in mind that the S&P 500 is somewhat heavily weighted with oil stocks, so higher prices may continue to help with that average. On the other hand, you might see more erratic stock price behavior in the Nasdaq and Russell 2000.

With all this in mind, I would continue to exercise caution due to economic headwinds that face the market in the longer run. This rally has priced in a good bit of stability of the next 12 months, but until we see significant improvement in job creation, I don't see how the consumer based U.S. economy performs very well. Traders and investors might do a lot better to continue focusing on overseas businesses.

Scott Cole www.bestdaytradingstocks.com

Wednesday, October 14, 2009

Back to Dow 10,000

The Dow Jones Industrial Average closed above 10,000 for the first time in over a year today on the back of stronger than expected retail sales data, and a better than expected earnings report from Intel. All of the major averages closed at new closing highs for the current bull move in stocks.

In other news today, the Federal Reserve in its minutes released from its latest meeting suggested that there are no near term inflation pressures and this gave a boost to stocks late in the day. The released minutes suggested that the Fed will hold its target interest rates at low levels for the foreseeable future.

On the flip side of the bullish day for stocks was drop in the Dollar Index and a rather sharp move up in yields on 10 Year Treasury Notes. The Dollar Index closed at 75.51, a new low for the year. Crude Oil closed over $75 per barrel today. So, we still see the inverse correlation between the Dollar and Crude Oil and between the Dollar and Stocks.

As a result of today's solid move in the stock market, we noted a number of nice daily price moves in stocks. At the top of the list were WATG and ASIA. These stocks demonstrated classic early breakout moves that translated into day long trending moves, providing daytraders very nice profits. The ASIA trade was particularly strong, as its intraday breakout occurred fairly close to its lows at around $21.50. The stock closed at $23.77, or about 10% above its breakout price. That is a super nice day trade!

Check out www.bestdaytradingstocks.com to learn more about capitalizing on these kinds of moves!

Scott Cole

In other news today, the Federal Reserve in its minutes released from its latest meeting suggested that there are no near term inflation pressures and this gave a boost to stocks late in the day. The released minutes suggested that the Fed will hold its target interest rates at low levels for the foreseeable future.

On the flip side of the bullish day for stocks was drop in the Dollar Index and a rather sharp move up in yields on 10 Year Treasury Notes. The Dollar Index closed at 75.51, a new low for the year. Crude Oil closed over $75 per barrel today. So, we still see the inverse correlation between the Dollar and Crude Oil and between the Dollar and Stocks.

As a result of today's solid move in the stock market, we noted a number of nice daily price moves in stocks. At the top of the list were WATG and ASIA. These stocks demonstrated classic early breakout moves that translated into day long trending moves, providing daytraders very nice profits. The ASIA trade was particularly strong, as its intraday breakout occurred fairly close to its lows at around $21.50. The stock closed at $23.77, or about 10% above its breakout price. That is a super nice day trade!

Check out www.bestdaytradingstocks.com to learn more about capitalizing on these kinds of moves!

Scott Cole

Sunday, October 11, 2009

Dow Rallies to New Closing Highs

The Dow Jones Industrial Average closed at a new high price for this bull market rally on Friday, while the S&P 500 came within a whisker of matching the Dow's achievement. The Nasdaq Composite and Nasdaq 100 have a bit more work to do yet.

While prices are still going higher, volume continues to shrink. Last week's rally occurred with much less volume than the previous week's decline. As such, I would remain a bit cautious as to whether the market can truly push much higher from here. It may need a little more time to consolidate last week's gains. Overall, it seems that the market still wants to head higher. Keep an eye on the Dollar though. At this point, there is still a strong inverse correlation between the Dollar and stocks. Any reversal in the Dollar's downtrend may hurt U.S. stocks.

The leading industry groups continue to be dominated by commodity based industries, and a couple tech related groups as well as the casinos. Leading indicator groups such as home furnishing stores, recreational vehicles and retail REITs are also among the best performers.

Enjoy the week!

Scott Cole

While prices are still going higher, volume continues to shrink. Last week's rally occurred with much less volume than the previous week's decline. As such, I would remain a bit cautious as to whether the market can truly push much higher from here. It may need a little more time to consolidate last week's gains. Overall, it seems that the market still wants to head higher. Keep an eye on the Dollar though. At this point, there is still a strong inverse correlation between the Dollar and stocks. Any reversal in the Dollar's downtrend may hurt U.S. stocks.

The leading industry groups continue to be dominated by commodity based industries, and a couple tech related groups as well as the casinos. Leading indicator groups such as home furnishing stores, recreational vehicles and retail REITs are also among the best performers.

Enjoy the week!

Scott Cole

Tuesday, October 6, 2009

Stocks follow through on Monday rally

U.S. stocks followed through on yesterday's gains to post another 100+ point performance in the Dow. Most of the other major averages made larger percentage gains. It appears that the major averages will be re-testing the September and bull market highs in the near future. However, they are doing so after a larger downside move than the pullbacks seen in August and early September. With that in mind, this re-test could end up as a classic double top, or it will require a bit more consolidation to move significantly above these highs.

The downside to all this is that there is a very high inverse correlation between stocks and the dollar. The dollar was hit today as it was rumored that the oil sheiks are getting a little antsy about pricing oil in dollars. This caused a big spike up in Gold, which closed at all time highs. Gold is a traditional inflation hedge, and it is widely felt that the Chinese are hedging their investments in U.S. Treasuries with the yellow metal.

Gold and Oil stocks provided some solid daytrading opportunities and some high momentum stocks broke out of their recent consolidation patterns to post new highs. A number of others are poised to make new breakouts as well, but as this rally is getting a bit long in the tooth, I suggest that traders should remain cautious and not have all of their cards on the table. While today's volume was a bit better than yesterday, it remains relatively light. Any new high in the major averages over the next week or so will result in some divergences in several price/volume indicators.

Stay tuned!

Scott Cole

The downside to all this is that there is a very high inverse correlation between stocks and the dollar. The dollar was hit today as it was rumored that the oil sheiks are getting a little antsy about pricing oil in dollars. This caused a big spike up in Gold, which closed at all time highs. Gold is a traditional inflation hedge, and it is widely felt that the Chinese are hedging their investments in U.S. Treasuries with the yellow metal.

Gold and Oil stocks provided some solid daytrading opportunities and some high momentum stocks broke out of their recent consolidation patterns to post new highs. A number of others are poised to make new breakouts as well, but as this rally is getting a bit long in the tooth, I suggest that traders should remain cautious and not have all of their cards on the table. While today's volume was a bit better than yesterday, it remains relatively light. Any new high in the major averages over the next week or so will result in some divergences in several price/volume indicators.

Stay tuned!

Scott Cole

Monday, October 5, 2009

Directional Bias

One significant way a day trader can outperform his/her peers is by learning how to trade only in the direction of the overall stock market on any given day. In other words, if the market is up, the day trader should only focus on long positions. If the market is down, the day trader should only focus on short positions.

The obvious difficulty is in being on the right side of the market! However, a little chart analysis is all the trader needs to stay on the right side of the market most of the time.

First of all, identify the current intermediate term trend. I define this trend with a 13 day and 34 day moving average. When the 13 day average is above the 34 day average, the market is in an uptrend, and the market is in a downtrend if the 13 day is below the 34 day.

Next, I look at the trading pattern over the last 3 to 5 days. If these days are up, I will have a bullish bias, unless I see any kind of a reversal pattern, such as declining volume and a narrowing trading range as the market trades higher.

The best patterns are those where the market has traded against the trend for a few days, and on the last day, drops into a strong support area on the charts, or trades in a very narrow trading range. Once I see a pattern like that, I look for any kind of intraday strength to initiate long positions.

The key to all this is that if the market is up solidly, the majority of stocks will also trade higher. Therefore, it makes no sense to try and trade against the underlying trends.

If you trade in the direction of the underlying market, I KNOW you will be more profitable!

Scott Cole

http://www.bestdaytradingstocks.com

The obvious difficulty is in being on the right side of the market! However, a little chart analysis is all the trader needs to stay on the right side of the market most of the time.

First of all, identify the current intermediate term trend. I define this trend with a 13 day and 34 day moving average. When the 13 day average is above the 34 day average, the market is in an uptrend, and the market is in a downtrend if the 13 day is below the 34 day.

Next, I look at the trading pattern over the last 3 to 5 days. If these days are up, I will have a bullish bias, unless I see any kind of a reversal pattern, such as declining volume and a narrowing trading range as the market trades higher.

The best patterns are those where the market has traded against the trend for a few days, and on the last day, drops into a strong support area on the charts, or trades in a very narrow trading range. Once I see a pattern like that, I look for any kind of intraday strength to initiate long positions.

The key to all this is that if the market is up solidly, the majority of stocks will also trade higher. Therefore, it makes no sense to try and trade against the underlying trends.

If you trade in the direction of the underlying market, I KNOW you will be more profitable!

Scott Cole

http://www.bestdaytradingstocks.com

Wednesday, May 27, 2009

Big Moves for Daytraders

Tuesday's stock market price action provided great opportunities for daytraders to capitalize on significant price moves. Daytraders who look to capture big directional moves could see this type of day coming just by looking at the daily charts of the stock indexes and some of the most widely traded big cap stocks. The stock market was set up nicely for a rally once a catalyst was provided. That catalyst proved to be the monthly consumer confidence report. Whether you believe consumers are ready to start spending does not matter. That report provided a boost to the stock market, which was already exhibiting some nice strength early in the session. The end result was numerous individual stocks making 10% moves to the upside, and some big cap stocks making 5% moves or more.

I hope you were one of those traders that made some big money on Tuesday!

Scott Cole

www.bestdaytradingstocks.com

I hope you were one of those traders that made some big money on Tuesday!

Scott Cole

www.bestdaytradingstocks.com

Wednesday, April 1, 2009

Stocks make gains after lower open

U.S. stocks managed a nice rally on Wednesday, suggesting the current move from the lows may still be intact. We'll know more later in the week after the Friday jobs report is released by the government.

Stocks were set to open lower today after the release of the ADP private sector jobs report showed a loss of 742,000 jobs in March. Later in the morning, subsequent economic data showed some improvement in the housing market and manufacturing, and the market rallied on that news. I should indicate this data showed a SLIGHT improvement, but the market is looking for any excuse to rally, so it is best to go along for the ride!

As a result of the rally, we had some good moves in several of our stock picks in out Best Daytrading Stocks newsletter. For more info, check it out here!

In other markets, the Dollar was generally flat on the day, and traded within a narrow range, ahead of the G-20 summit in London. I don't expect much to come out of this meeting except some posturing rather than any strong policy. There was not much movement in Treasuries or commodities today either. Most of these markets are trading within consolidation patterns as we wait to see if and when the economy may recover.

Scott Cole

www.bestdaytradingstocks.com

Stocks were set to open lower today after the release of the ADP private sector jobs report showed a loss of 742,000 jobs in March. Later in the morning, subsequent economic data showed some improvement in the housing market and manufacturing, and the market rallied on that news. I should indicate this data showed a SLIGHT improvement, but the market is looking for any excuse to rally, so it is best to go along for the ride!

As a result of the rally, we had some good moves in several of our stock picks in out Best Daytrading Stocks newsletter. For more info, check it out here!

In other markets, the Dollar was generally flat on the day, and traded within a narrow range, ahead of the G-20 summit in London. I don't expect much to come out of this meeting except some posturing rather than any strong policy. There was not much movement in Treasuries or commodities today either. Most of these markets are trading within consolidation patterns as we wait to see if and when the economy may recover.

Scott Cole

www.bestdaytradingstocks.com

Monday, March 30, 2009

A Weak Monday

Just a weak day, not much can be said about today's action. The best place to be was on the short side, and one of our picks, Schnitzer Steel, was off 11%. Unfortunately, most of this move occurred in the first five minutes, so it was not a good trade for our basic opening range breakout strategy. However, it did provide some good scapling opportunities for traders who like to be more active.